How can we help you?

The new Company Code will have a significant impact on the Belgian corporate landscape. With a date of application as from 1 May 2019, we advise you to explore the various options available to you as soon as possible with a view to making the most of the upcoming changes. From that date, existing companies and associations will have the possibility to voluntarily opt-in to the new requirements.

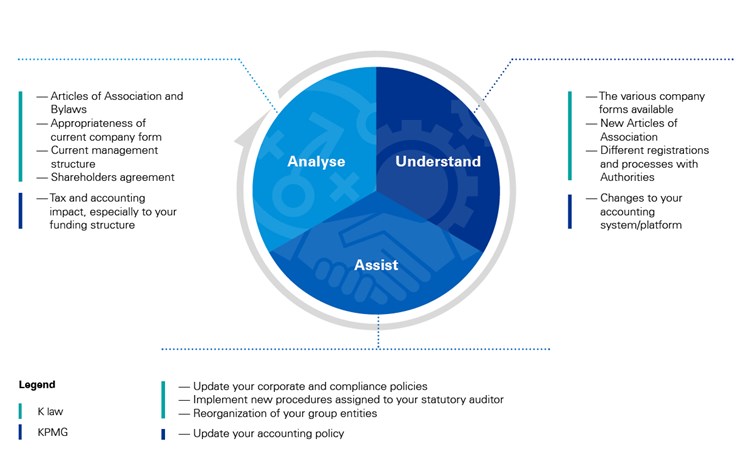

At KPMG and KPMG Law, our experts are here to guide you along the road to compliance by providing you with the below services.

The new Company Code will have a significant impact on the Belgian corporate landscape. With a date of application as from 1 May 2019, we advise you to explore the various options available to you as soon as possible with a view to making the most of the upcoming changes. From that date, existing companies and associations will have the possibility to voluntarily opt-in to the new requirements.

At KPMG and KPMG Law, our experts are here to guide you along the road to compliance by providing you with the below services.

KPMG Law:

- An analysis of your Articles of Association and Bylaws with suggestions on what needs to be revised to ensure compliance with the Code;

- An analysis of your current company form with a recommendation on whether the status quo can be maintained (e.g. the cooperative company will only be available for truly cooperative companies), or if necessary, what the most suitable form for your activities is;

- Should your company form be abolished (e.g. Comm.VA/SCA) assist you in identifying the most suitable available company form for your operations and guide you through the transformation process;

- Assist you with the updating of your corporate and compliance policies to ensure compliance with the new Company Code (e.g. in the event that dividends should be distributed or in the limitation of liability for directors);

- Assess whether your current management structure and composition conforms to the new Code and is best suited for your organization (e.g. you will be able to appoint a managing director in a limited company (BV/SRL));

- Should you be involved with a non-for-profit legal entity, assist you in updating your Articles of Association to ensure this entity may continue to conduct commercial activities;

- Assist with implementing new procedures arising from new tasks that are assigned to your statutory auditor;

- Prepare and, if needed, implement a rollout plan for the reorganization of your group entities in Belgium in conformity with the new Code;

- Assist you with the different registrations (e.g. with the Crossroads Bank for Enterprises) and official requests (e.g. to become a certified cooperative) with the Authorities

KPMG:

- Assess the tax and accounting impact of the new Code on your Belgian entities, especially when making changes to the entities’ funding (e.g. contribution of labor, different classes of shares not representing share capital for a limited company (BV/SRL), distributions of equity etc.);

- Assist you with updating your accounting policy and advising on changes for your accounting system/platform (e.g. new accounting entries)